Offering a white-labeled lending service in emerging markets, Mines raises $13 million

Emerging markets credit startup Mines.io has closed a $13 million Series A round led by The Rise Fund, the global impact fund formed by private equity giant TPG, and 10 others, including Velocity Capital.

Mines provides business to consumer (B2C) “credit-as-a-service” products to large firms.

“We’re a technology company that facilitates local institutions — banks, mobile operators, retailers — to offer credit to their customers,” Mines CEO and co-founder Ekechi Nwokah told TechCrunch.

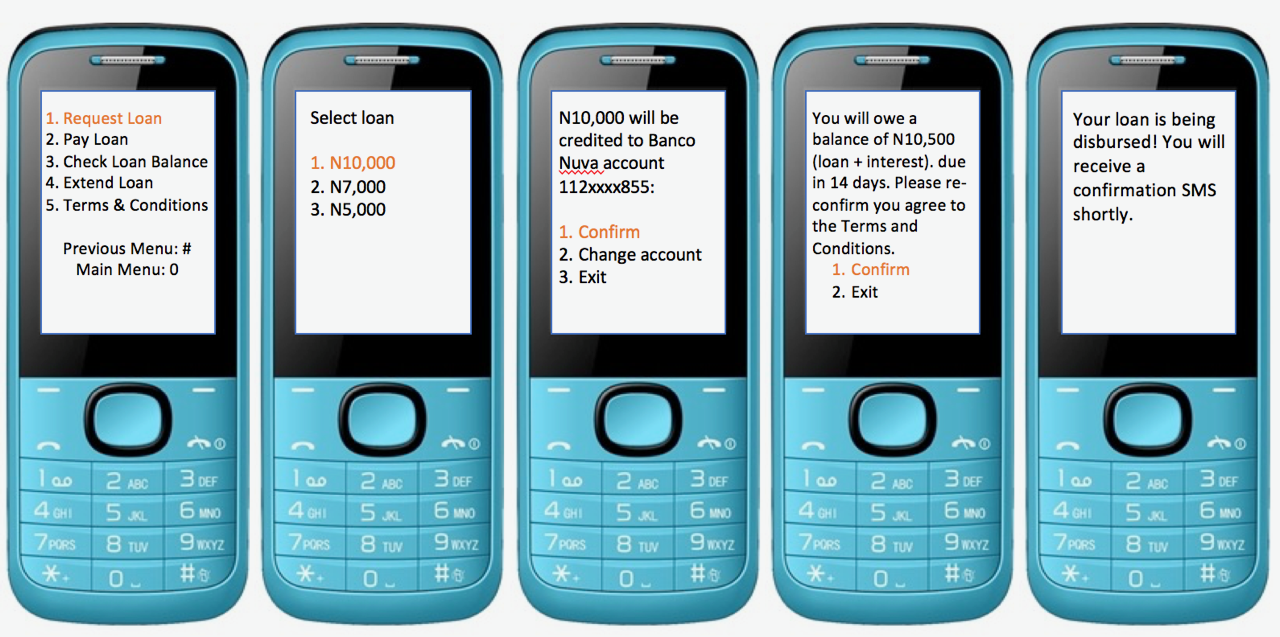

Most of Mines’ partnerships entail white-label lending products offered on mobile phones, including non-smart USSD devices.

With offices in San Mateo and Lagos, Mines uses big-data (extracted primarily from mobile users) and proprietary risk algorithms “to enable lending decisions,” Nwokah explained.

“We combine a strong AI technology with full…deployment services — disbursement…collections, payments, loan management, and regulatory — wrap it up in a box, give it to our partners and then help them run it,” he said.

Mines’ typical client is a company “that has a large customer base and wants to avail credit to that customer base,” according to Nwokah. The startup generates revenue from fees and revenue share with partners.

Mines started operations in Nigeria and counts payment processor Interswitch and mobile operator Airtel as current partners. In addition to talent acquisition, the startup plans to use the Series A to expand its credit-as-a-service products into new markets in South America and Southeast Asia “in the next few months,” according to its CEO.

Mines sees itself as a “hardcore technology company based in Silicon Valley with a global view,” according to Nwokah. “At the same time, we’re very African,” he said.

The startup’s leadership team is led by three Nigerians — Nwokah, Chief Scientist Kunle Olukotun and MD Adia Sowho. The company came together after Olukotun (then and still a Stanford professor) and Nwokah (a then-AWS big data specialist) met in Palo Alto in 2014.

Looking through the lens of their home country Nigeria, the two identified two problems in emerging markets: low access to credit across large swaths of the population and insufficient tools for big institutions to put together viable consumer lending programs.

Due to a number of structural factors in these markets, such as low regulatory support, lack of credit data and tech support, “there’s no incentive for many banks and institutions to take risk on a retail lending business,” according to Nwokah.

Nwokah sees Mines’ end user market as “the more than 3 billion adults globally without access to credit,” and its direct client market as big “banks, retailers and mobile operators…who want to power digital credit tailored to these markets.”

Mines views itself as different from the U.S.’s controversial payday lenders by serving different consumer needs. “If you live in a country where your salary is not guaranteed every month, where you don’t have a credit card…where you have to pay upfront cash for almost everything you do, you need cash,” he said

The most common loan profile for one of Mines’ partners is $30 at 15 percent flat for a couple of weeks.

Nwokah wouldn’t name specific countries for the startup’s pending South America and Southeast Asia expansion, but believes “this technology is scalable across geographies.”

As part of the Series A, Yemi Lalude from TPG Growth (founder of The Rise Fund) will join Mines’ board of directors.

On a call with TechCrunch, Lalude named the company’s ability to “drive financial inclusion within a matter of seconds from mobiles devices,” their “local execution on the ground” and model of “partnering with many large organizations with their own balance sheets” as reasons for the investment commitment.

With Mines’ pending Asia and South America move they join Nigerian tech companies MallforAfrica.com and data analytics firm Terragon Group, who have expanded or stated plans to expand internationally this year.