Wealthsimple Unveils Canada’s First Zero-Commission Stock Trading Service

One of Canada’s premier fintech darlings has a new service aimed at bringing stock trading to younger generations.

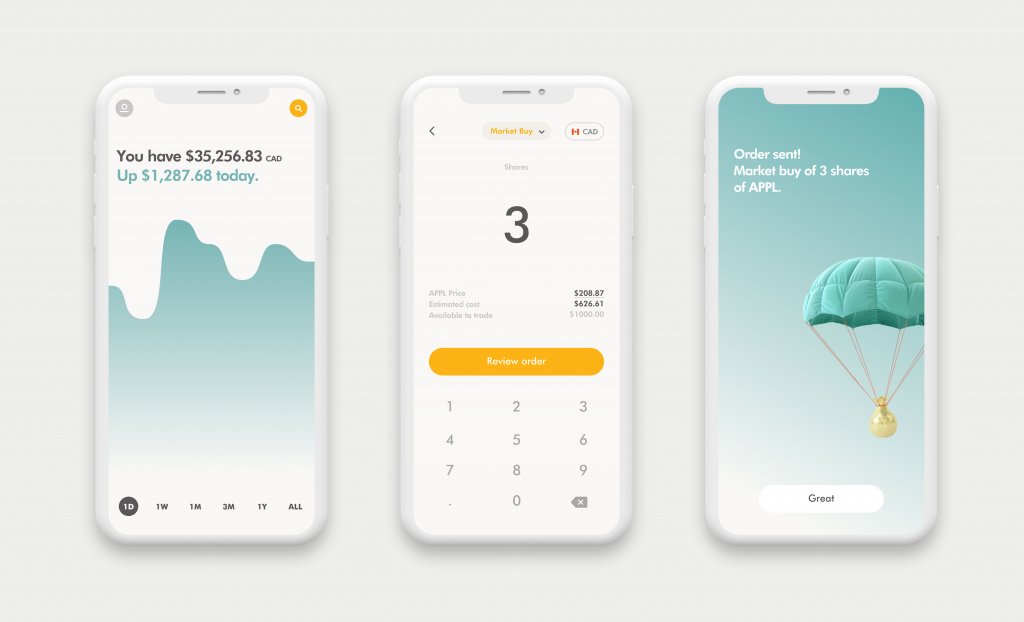

Wealthsimple has launched a new service called Wealthsimple Trade, allowing clients to buy, sell and trade stocks and exchange-traded funds (ETFs) through a simple mobile app. Wealthsimple customers will have access to unlimited $0 commission trades of over 8,000 publicly-traded stocks and ETFs listed on both Canadian and U.S. stock exchanges.

“The options for stock trading in Canada aren’t great — traditional brokerages have high fees, the technology is dated and clunky, and the experience isn’t exactly user-friendly,” said Mike Katchen, CEO and co-founder of Wealthsimple. “We saw an opportunity to take the simple, human approach we’re known for and apply it to the trading experience.”

As of publishing, the feature is in early-access with over 10,000 interested parties on the waitlist. Customers can move up the list by referring other friends or clients. Only a few will be allowed to access this beta, and it will open to the public shortly. Opening an account takes minutes, and customers can begin trading with as little as one dollar, though there appears to be a limit as the site says “sign up in minutes and trade up to $1,000 instantly.” That limit will be increased over time.

The stock-trading services offered right now can be cumbersome and inaccessible to those without much experience, and that’s a problem Wealthsimple is trying to address with this new platform. It seems to be geared towards those who want to dip a toe into the stock world and learn about making investments without having to open a securities account or meet with a broker.

“Our approach to investing hasn’t changed: the smartest way to grow your money long-term is to have a diversified, low-cost portfolio that tracks the market, contribute regularly, and stay the course,” said Katchen. “But that doesn’t mean there’s no place for buying and selling individual stocks — as long as it’s done responsibly as part of a holistic financial plan.”

Wealthsimple Trade was built in eight short weeks by a small team of the company’s designers and developers. A final parting note on a release shows that Wealthsimple Trade is still subject to some regulatory approvals and is offered by Canadian ShareOwner Investments Inc.

The Toronto fintech has been on a tear so far in 2018, raising $65 million from their institutional investors then passing over $2 billion in total assets managed shortly thereafter.